Why do our investors invest for impact? Takeaways from our 2020 Impact Investor Survey

September 15, 2020

Every two years, we conduct an investor survey to better understand the motivations of our investor base, the challenges they face in investing for impact, and how we can serve them better. This survey is intended not only to inform our work, but also to provide feedback that the entire impact investing industry can utilize. To that end, since 2018, we have opened the survey to gather insights from the broader impact investing community in addition to our investors.

We launched the survey in February this year, shortly before the COVID-19 pandemic hit the US. Needless to say, investors, ourselves included, had things other than surveys on their minds. However, as the world began to adjust, we heard from investors and advisors that they were more interested in impact investing than ever before. We wanted to capture this surge of interest in impact investing, as well as the increased interest in investing for racial justice and equity, so we relaunched our survey in June 2020.

More than 700 people responded to the survey, providing key insights which you can read below. For more information on our investors and why they invest for impact, download the Investor Infographic.

1. Our investors are diverse across age, gender, wealth, and income.

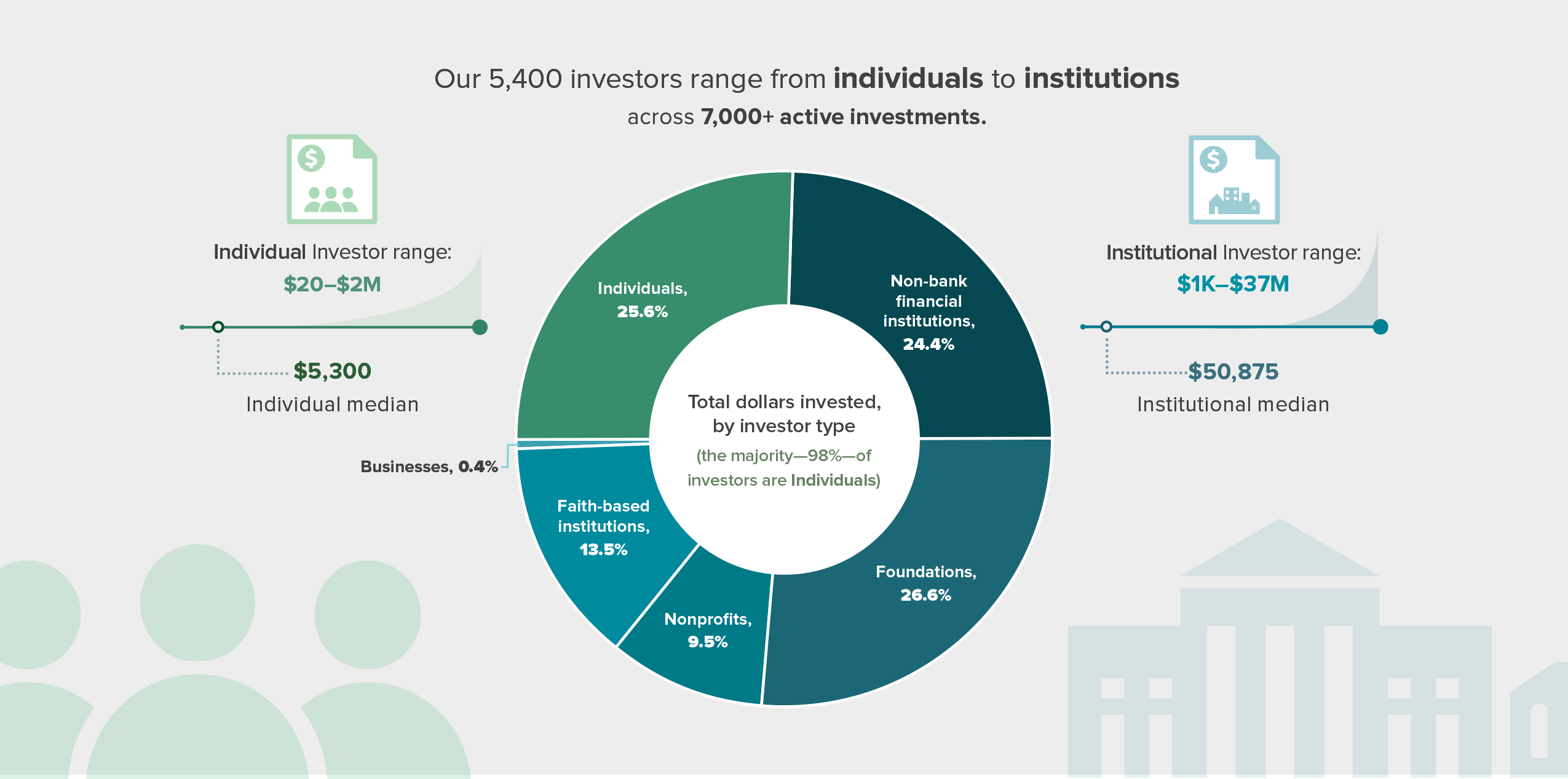

Our investors are a diverse group – retail investors that range from the impact investing ‘newbie’ who made their first $20 impact investment to the veteran impact investor who manages their entire portfolio with impact strategies; our institutional investors that range from financial institutions to foundations, faith-based institutions, and other nonprofits.

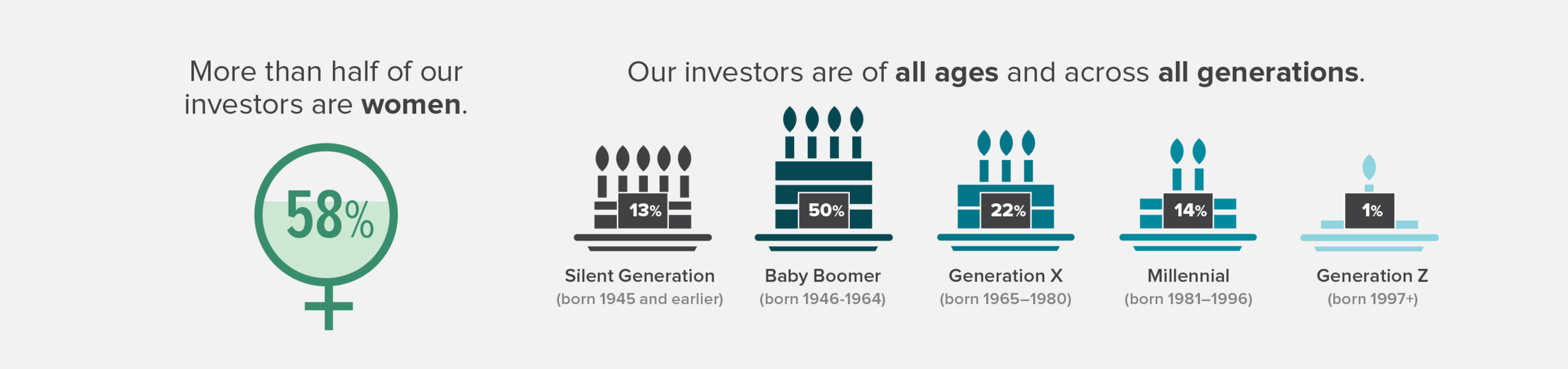

Our individual investors live across all 50 US states plus DC, Puerto Rico, and the US Virgin Islands. They span a range of generations, from the Silent Generation all the way to Generation Z, including those just starting their careers and building their investment portfolios to those about to retire with a robust investment portfolio. Over half of our investor survey respondents were women.

While you don’t need a financial advisor to invest in the Community Investment Note®, 53% of our investors work with advisors – and 27% indicated an advisor helped them invest in the Note. 27% of our investors also rely on their advisors for general information on impact investing.

Check out the infographic for a more detailed breakdown of who these investors are.

2. They invest to mitigate climate change, build equity, and create opportunity.

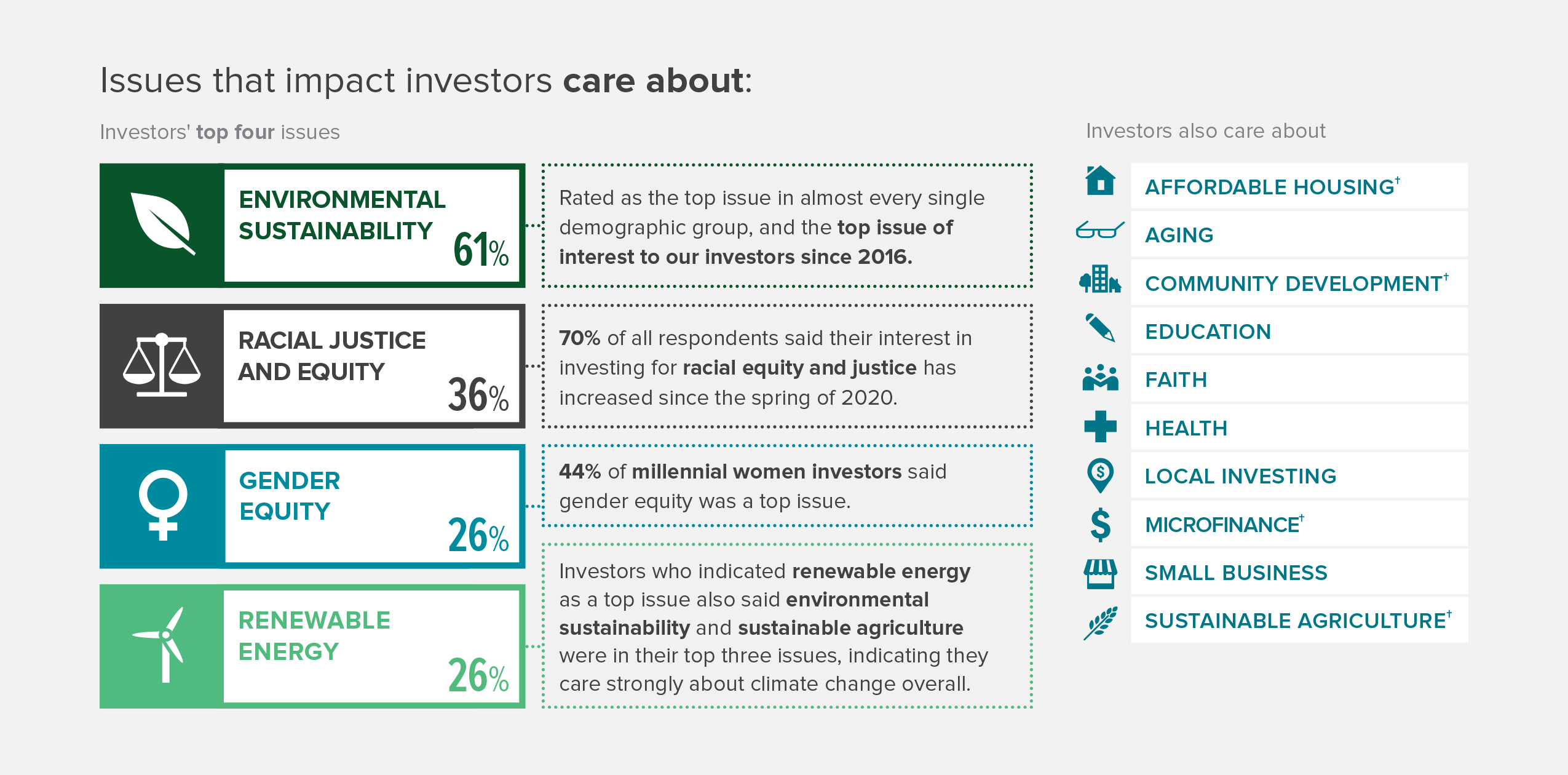

When asked to choose the top 3 issue areas that they care most about, investors overwhelmingly chose environmental sustainability. Since our 2016 survey, environmental sustainability has been rated as the #1 issue in nearly every demographic group. Renewable energy was also rated a top issue by 26% of investors. Additionally, 62% of investors explicitly responded that they invest “to positively influence climate change.”

Our investors also care deeply about racial justice and equity, as well as gender equity and women’s empowerment. 36% of our investors indicate racial justice and equity is a top concern, and 70% of respondents are more interested in making investments to support racial equity since spring 2020.

(It should be noted that most investors who indicated their interest level had not changed said so because they have always been interested in investing for racial justice and equity, and also understand that other issue areas such as small business and affordable housing are intertwined with racial justice. As one investor put it, “Sisters have had a focus on racial equality and justice for years.”)

While Calvert Impact Capital is a secular organization, many of our investors are also motivated to align their investments with their values and their faith. In fact, 26% of investors responded that they “invest because it’s aligned with my faith.” You can learn more about our work with faith-based investors on our website.

3. COVID-19 has catalyzed many investors to invest for impact.

Since we relaunched the survey in June 2020, 44% of respondents were more likely to invest for impact given the effects of COVID-19 on sectors across the globe. Moreover, 72% of millennials said they are more likely to invest for impact since the COVID-19 pandemic began.

That interest has also translated into action: 21% of respondents overall and 35% of millennials have made new impact investments since the beginning of the pandemic.

4. Investors need more accessible products and information so they can invest more of their portfolio for impact.

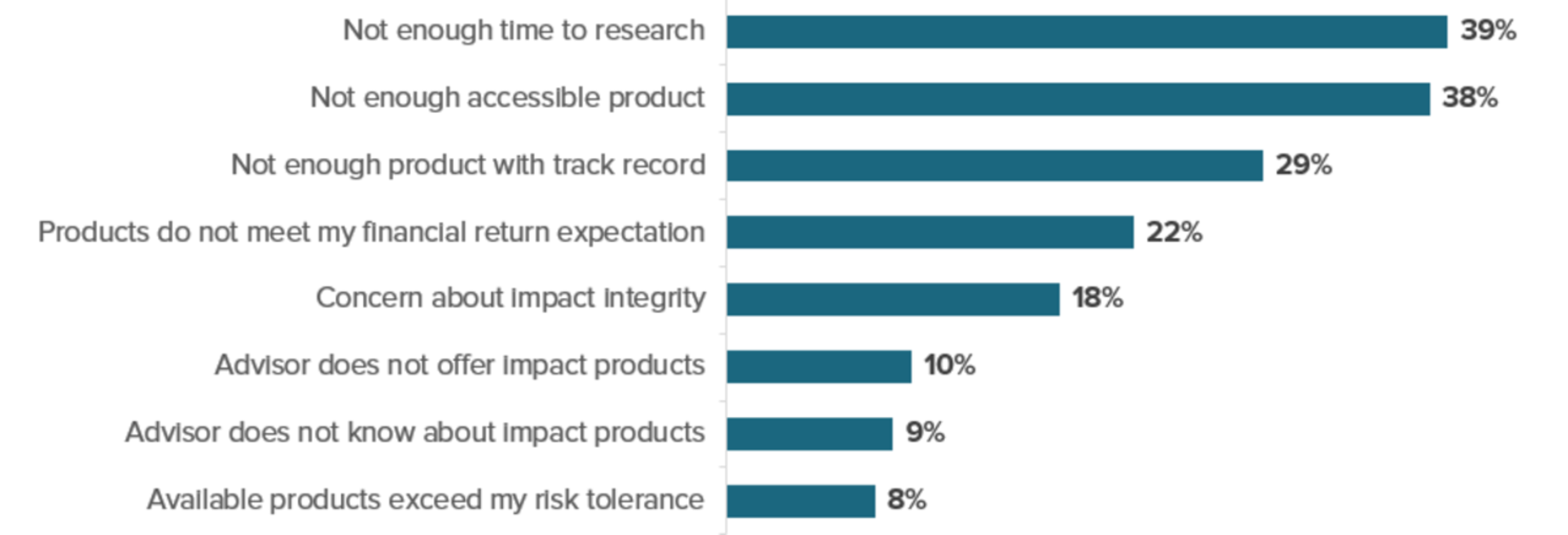

Only 60% of our investors have impact investments other than the Community Investment Note®, but 65% (and 81% of millennials) intend to increase their impact investments as a portion of their overall investment portfolio. However, investors indicate they face challenges including:

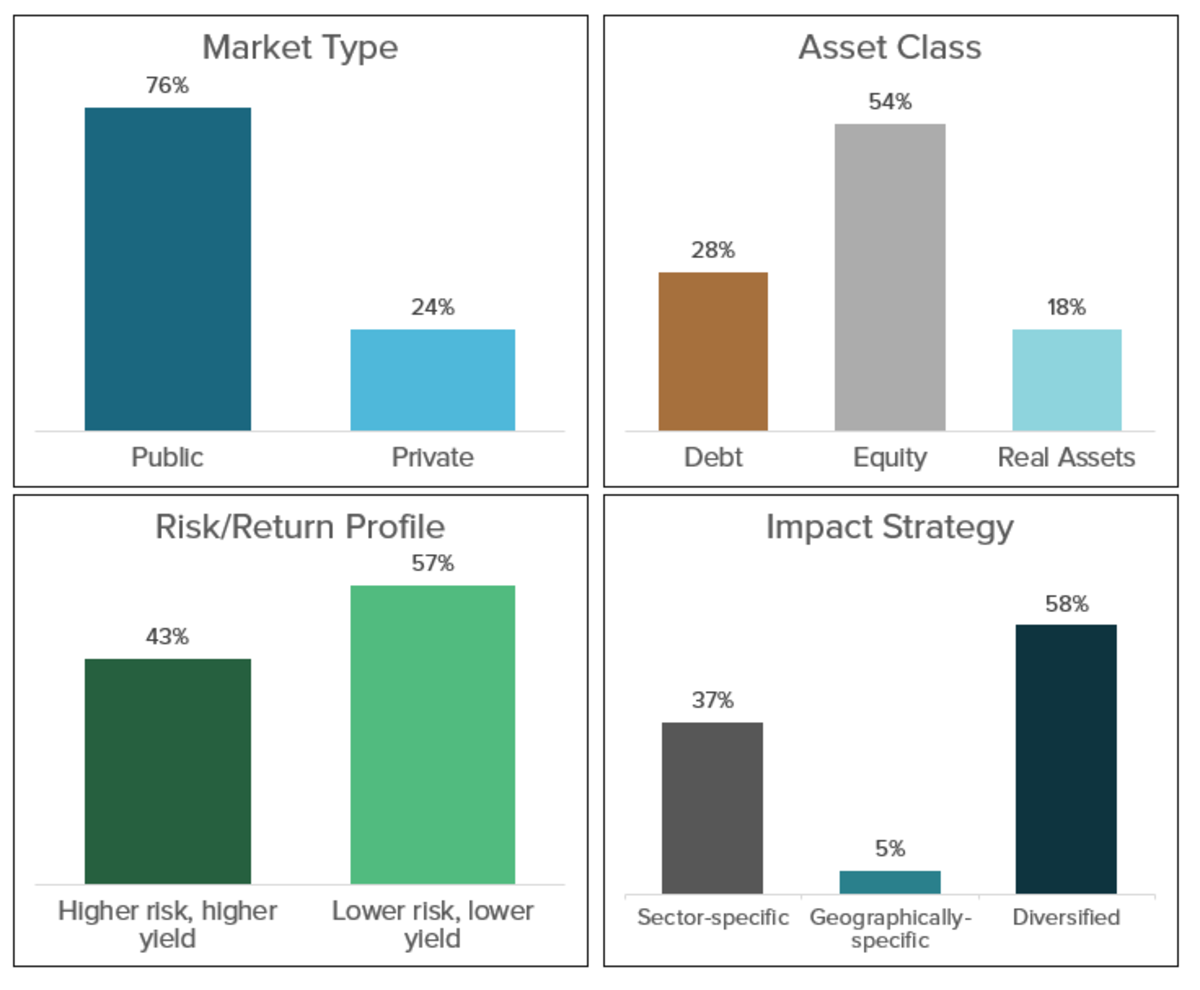

Perhaps because of these challenges, 87% of investors want to see more impact products in the market. They indicated their ideal products to have the following attributes:

Overall, investors are interested in more public equities, roughly split between risk/return profiles, and the majority want more impact and geographic diversification.

5. The Community Investment Note® is a gateway to impact.

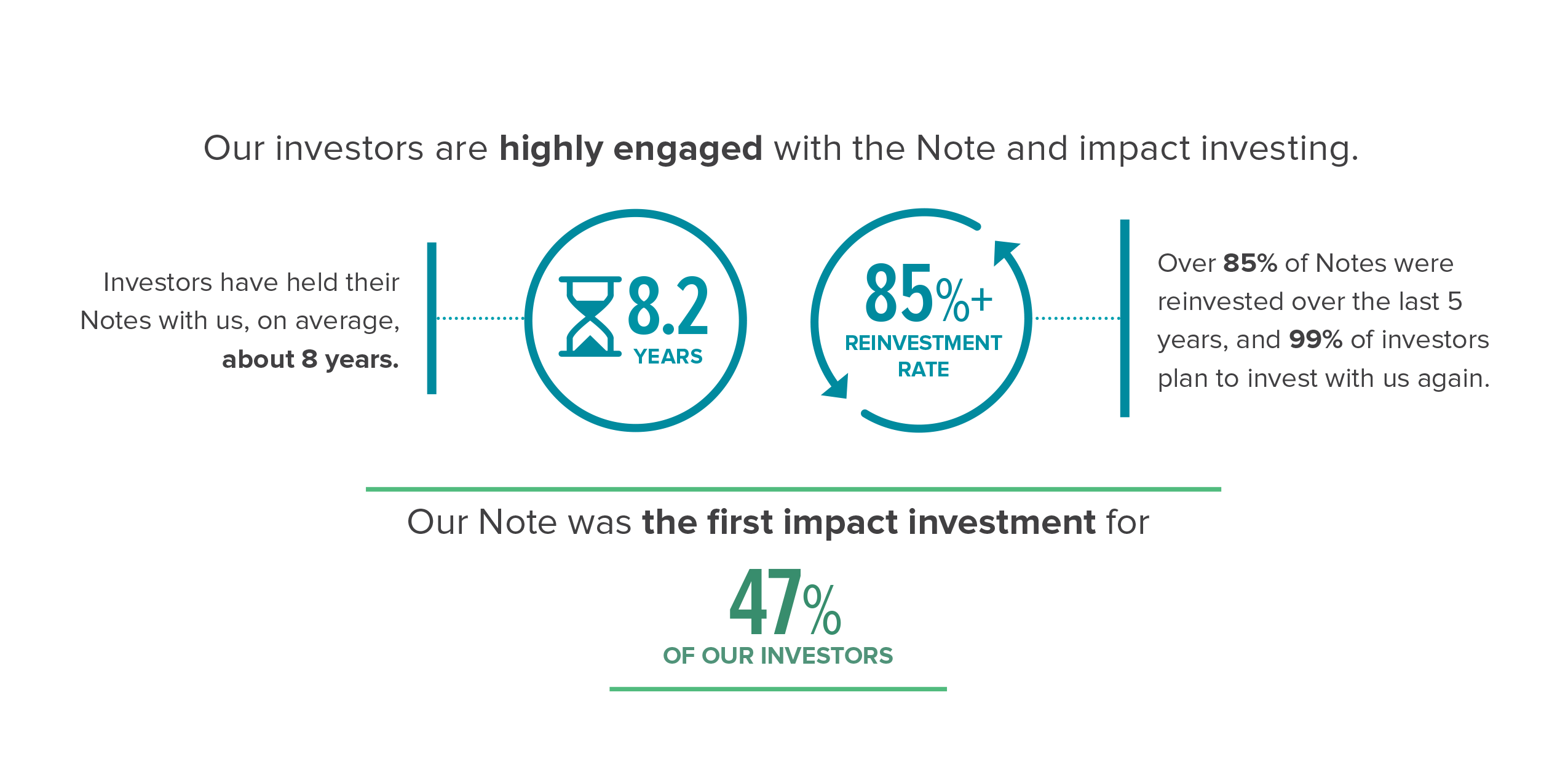

Investors continue to rely on the Community Investment Note® as a gateway product to impact investing. 47% of investors stated the Note was their first cause-based or impact investment and 40% stated the Note is their only impact investment. 99% of investors stated they would consider investing with us in the future.

Our investors hold their Notes for an average of 8.2 years and reinvest at an 85% reinvestment rate – meaning that investors see the value of reinvesting in the Note and in our mission to channel capital to communities and create a more equitable and sustainable world.

_Check out the infographic{target="blank"} to learn more about our investors and why they invest in the Community Investment Note®.